The latest industry report by Training magazine on the U.S. training industry reveals how much U.S. companies spend training employees, which decreased to $98 billion in 2024.

Digging into the numbers, payroll for in-house training decreased once again from $63 billion in 2023 to 60.6 billion in 2024. The report found that spending on outside training products and services rose by 23 percent to $12.4 billion.

Average training expenditures for large companies (10,000 or more employees) decreased from $16.1 million in 2023 to $13.3 million in 2024. Expenditure by midsize companies (1,000 to 9,999 employees) increased from $1.5 million to $1.7 million, while small companies (100 to 999 employees) decreased their training budgets from $459,177 to $374,207.

How much does it cost to train an employee in U.S.

Tools and technologies for learning

Hours of training per employee

Learning and development budgets by industry

Training delivery in the U.S.

Types of training

Training outsourcing

How much does it cost to train an employee in the UK

UK L&D budgets and programs

Learning delivery in UK

Tackling L&D challenges

Tackling course creation challenges

How much does it cost to train an employee in U.S.

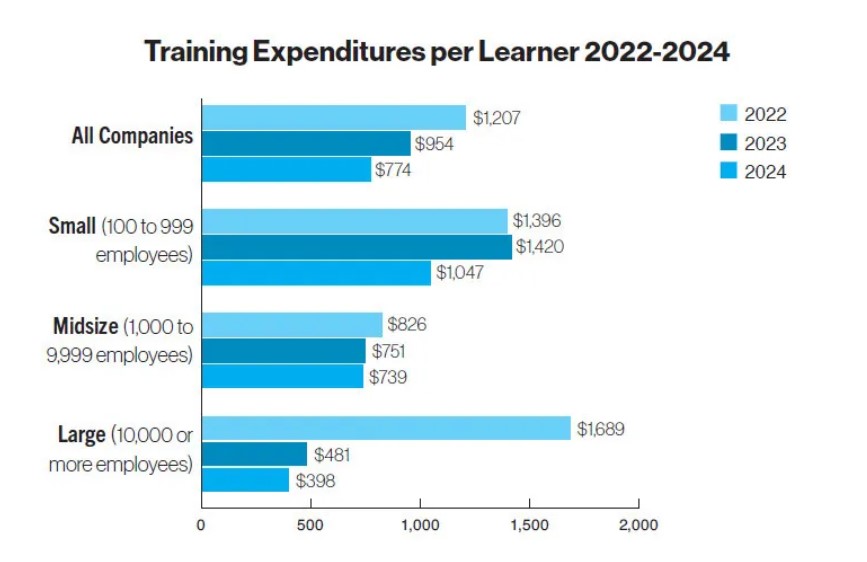

Regarding the amount companies spend training employees across organizations of all sizes, employee training decreased to $774 per learner in 2024 compared with $954 per learner in 2023.

When you break down the numbers by company size, the survey found that large companies spent less on training in 2024 – $398 per learner in 2024 compared to $481 per learner in 2022.

Small companies also spent significantly less in 2024, while midsize companies almost the same when compared to 2023. Small companies spent $1,047 per employee in 2024 compared to $1,420 per employee in 2023. Expenditures by midsize companies dropped to $739 per learner in 2024 compared to $751 per learner in 2023.

Cost of employee training (per employee) 2022-2024. Source: Trainingmag.com

Tools and technologies for learning

When it comes to expenditures on tools and technologies, organizations spent an average of 13 percent of their budget, or $268,397 (down from $360,164 last year), on learning tools and technologies. Large and midsize government and military organizations allocated the highest budgets for learning tools, with $2 million and $1.2 million, respectively. In comparison, large education organizations dedicated the largest share of their budgets (22%) to learning tools this year.

Looking ahead, the most commonly anticipated purchases are games and simulations, which have climbed to the top spot to 46 percent from 41 percent in 2023. Online learning tools and systems, along with business skills, are both at 39 percent, compared to 43 percent and 37 percent, respectively, the previous year. Courseware design stands at 33 percent, slightly down from 35 percent last year, while assessment and analysis testing saw a significant rise to 31 percent from 12 percent. Classroom tools and systems are at 29 percent, slightly decreasing from 31 percent.

This year, coaching/mentoring was introduced as a new category and garnered 28 percent. Consulting increased to 25 percent, up from 23 percent last year. Content development and authoring tools/systems both experienced a slight 1 percent decline, now at 16 percent and 11 percent, respectively. Learning management systems (LMS) also dropped by 2 percent, settling at 15 percent. Meanwhile, augmented and virtual reality technologies decreased to 8 percent from 10 percent last year.

Hours of training per employee

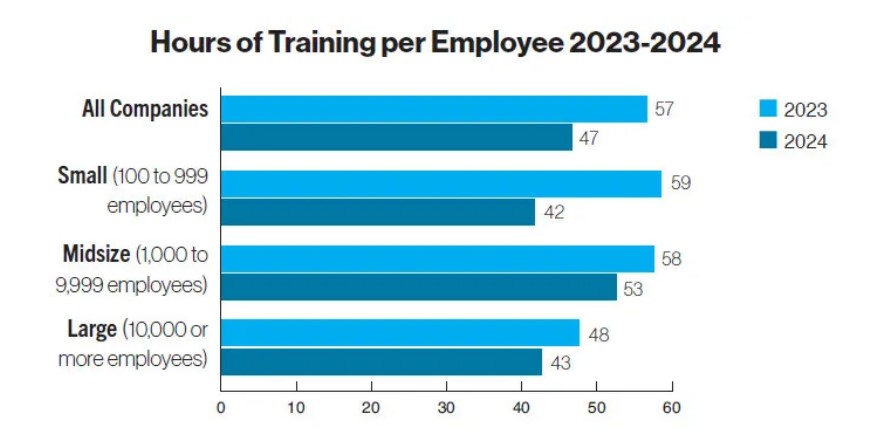

Not only did training budgets decreased, so did the number of hours of training per employee.

Across all organizations, employees spent less time in training—47 hours in 2024 compared to 57 hours in 2023. In 2024, companies with 1,000 to 9,999 employees spent 43 hours in training, compared to 48 hours in 2023. This represents a nearly 18 percent drop in training hours.

Small companies decreased the number of hours in corporate training—42 hours of training per learner in 2024 compared to 59 hours per learner in 2023. Midsize companies saw the lowest decrease in the number of hours of training per employee—53 hours of training in 2024 compared to 58 hours of training in 2023 (8.6 percent decrease).

Training hours per employee 2023-2024. Source: Trainingmag.com

Learning and development budgets by industry

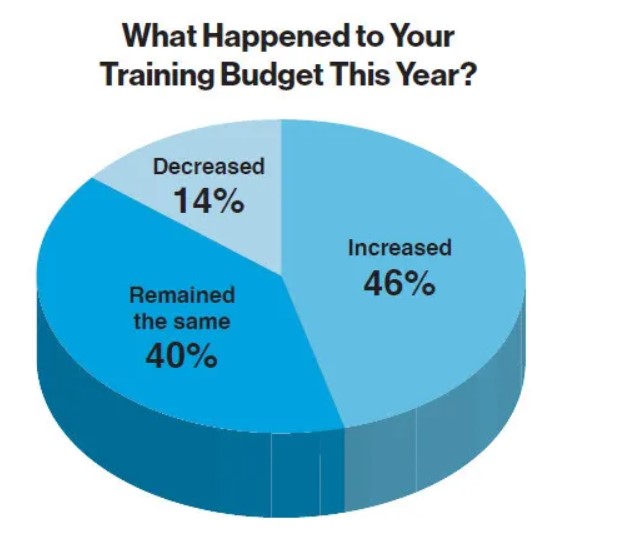

In 2024, the number of companies reporting that their budgets increased rose to 46 percent. Most of the budget increases were less than 16 percent. Around 32 percent of training budgets saw increases in the 6 to 15 percent range, while 37 percent of organizations reported increases in the 1 to 5 percent range compared with 30 percent in 2023. Most respondents who reported an increase in their training budgets attributed it to the following reasons:

- Increased scope of training programs (57 percent vs. 64 percent last year)

- Added training staff (52 percent vs. 54 percent in 2023)

- Increased number of learners served (44 percent vs. 48 percent last year)

- Purchased new technologies/equipment (38 percent vs. 44 percent in 2023)

Only 14 percent of organizations said their budgets decreased, and more than half of the respondents cited a drop of more than 16 percent. Some 49 percent reported budget decreases between 6 and 15 percent, and 26 percent cited 1 to 5 percent decreases. Over 74 percent cited cuts in training budgets due to economic uncertainty. The following reasons are how organizations reduced the amount spent on training programs:

- Budget adjusted to reflect lower costs and/or new training efficiencies (26 percent vs. 6 percent in 2023)

- Attended fewer outside learning events (23 percent vs. 18 percent last year)

- Decreased scope of training (13 percent vs. 12 percent in 2023)

- Decreased outside trainer/consultant investment (10 percent vs. 15 percent last year)

- Decreased number of learners served (10 percent vs. 9 percent last year)

- Other reasons such as reduction in federal grants post-COVID, change in the market, and negotiated lower fees for LMS (10 percent vs. 9 percent in 2023)

The survey showed that most manufacturers/distributors, retailers/wholesalers, government/military, and education said their budget remained unchanged.

Budget change by industry in 2024. Source: Trainingmag.com

Training delivery in the U.S.

Since the COVID-19 pandemic, companies have been shifting from remote training back to in-person sessions for certain skill areas. These include management and supervisory training (46 percent), onboarding (41 percent), and interpersonal skills training (35 percent).

Other types of training seeing a return to in-person formats are customer service training (26 percent); professional/industry-specific training, mandatory compliance training, and executive development (each at 22 percent); and sales training (19 percent). Meanwhile, 28 percent of organizations have not resumed any in-person training.

For the upcoming year, 69 percent of companies intend to maintain their current balance between in-person and remote training. Slightly more companies (16 percent) plan to increase in-person training compared to those aiming to expand remote training (13 percent). The most significant growth in in-person training is anticipated in areas such as management and supervisory training, interpersonal skills development, and executive leadership programs. For other training areas, preferences appear to be more evenly divided between in-person and remote options.

In terms of technology for training delivery, among the 11 learning technologies analyzed, the most widely adopted are:

- Learning Management Systems (LMSs): Utilized by 90 percent of organizations, a slight increase from 89 percent last year. Adoption rates are highest among large companies (100 percent) and midsize companies (94 percent), compared to 82 percent of small companies.

- Virtual Classroom/Webcasting/Video Broadcasting: Used by 79 percent of organizations, a decline from 85 percent last year.

- Rapid eLearning Tools and Mobile Applications: Both at 33 percent, with rapid eLearning down from 44 percent and mobile apps slightly up from 31 percent last year.

- Application Simulation Tools: Consistently at 26 percent.

- Artificial Intelligence: Saw significant growth, increasing from 9 percent last year to 25 percent this year.

- Learning Content Management Systems (LCMSs): Used by 25 percent, a minor drop from 27 percent last year.

- Online Performance Support Systems (EPSS) or Knowledge Management Systems: Stable at 18 percent.

- Podcasting: Declined slightly to 14 percent from 17 percent last year.

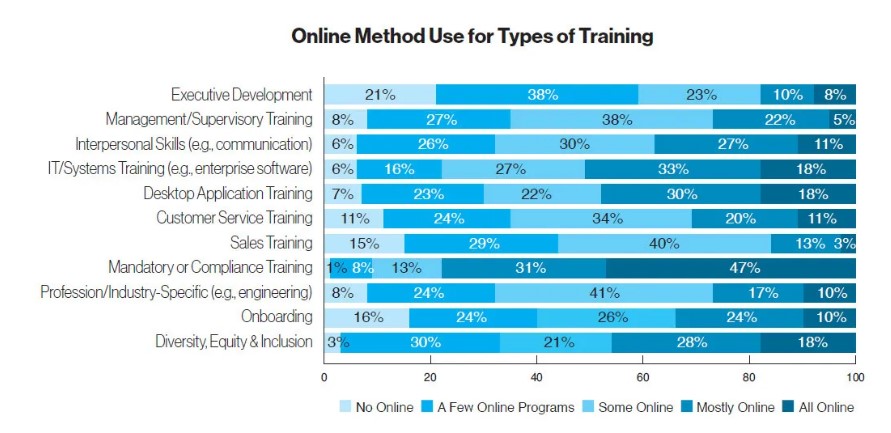

Types of training for online learning

Approximately 34 percent of training hours were delivered through online or computer-based technologies, a slight increase from 33 percent in 2023. The remaining training hours were distributed across various methods:

- Virtual classrooms and webcasting accounted for 27 percent of training hours, a marginal decline from 28 percent in 2023.

- Traditional instructor-led classroom sessions represented another 27 percent, down from 30 percent last year.

- Blended learning techniques comprised 24 percent of training hours, a notable drop from 32 percent the previous year.

- Mobile devices delivered 3 percent of training hours, compared to 4 percent in 2023.

- Social learning accounted for 5 percent of hours, down from 6 percent last year.

- Emerging technologies such as augmented and virtual reality remained rare, both at 0.3 percent, while artificial intelligence usage increased slightly, though still low at 0.8 percent.

Mandatory and compliance training was predominantly conducted online, with 91 percent of organizations incorporating some online components and 48 percent delivering it entirely online—up from 46 percent last year. Online training was also heavily used in:

- IT/systems training (78 percent),

- Desktop application training (70 percent),

- Interpersonal skills training (68 percent),

- Professional/industry-specific training and DEI training (both at 67 percent),

- Management/supervisory training and customer service training (both at 65 percent),

- Onboarding (60 percent),

- Sales training (56 percent).

Executive development saw the least reliance on online delivery, at just 40 percent.

Online method use for types of training (2024). Source: Trainingmag.com

Training outsourcing

In 2024, the average spending on training outsourcing declined to $241,311, compared to $322,376 in 2023. Large companies allocated an average of $907,250 to outsourcing, while midsize and small companies spent $234,864 and $46,758, respectively. On average, 6 percent of the total training budget was dedicated to outsourcing in 2024, up from 5 percent in 2023.

More instruction and facilitation were outsourced than managed internally, with 56 percent outsourced compared to 44 percent handled in-house. Across various topic areas, small and midsize companies outsourced at similar rates, while large companies outsourced about 10 percent more. Outsourcing increased with company size, particularly for custom content development and instruction/facilitation.

Outsourcing levels are projected to remain stable in 2025, with 88 percent of organizations expecting no change. The proportion of companies planning to increase outsourcing matches those intending to reduce it, both at 6 percent. Additionally, 56 percent of respondents indicated no plans to outsource learner support or LMS administration over the next 12 months.

When analyzed by company size, 48 percent of midsize companies expect to maintain their current outsourcing levels in 2025, compared to 40 percent of large companies and 36 percent of small ones. Large and small organizations are slightly more inclined to avoid outsourcing altogether.

How much does it cost to train an employee in the UK

According to a UK Department of Education research report, the amount UK companies spent training employees was on average, £1,800 per employee training a new employee in 2022. Training spending per trainee per annum was slightly higher in England and Wales (£1,800) than in Northern Ireland and Scotland (£1,700).

The most common type of training provided was job-specific training. Most employers also provided health and safety (or first aid) training and basic induction (onboarding) training for new staff.

The use of online training or e-learning was highest among employers providing training in the non-market services sectors, including Education (89 percent), Public Administration (86 percent), and Health and Social Work (86 percent). It was least common in the Primary Sector and Utilities (43 percent), which remains the only sector where fewer than half of training employers utilized online or e-learning over the past 12 months.

While all sectors have seen an increase in the use of online training since 2017, particularly significant growth occurred in Transport and Storage (59 percent, up from 35 percent in 2017), Arts and Other Services (63 percent, up from 42 percent in 2017), and the Primary Sector and Utilities (43 percent, up from 23 percent in 2017), despite being the least likely to adopt online training.

UK L&D budgets and programs

UK’s Chartered Institute of Personnel and Development (CIPD) also conducts an annual survey that examines current practices and trends within learning and development (L&D).

The latest survey which was released in June 2023 found that 45 percent indicated that how much companies spend training employees stayed the same, while 24 percent said that their L&D budgets increased in the last 12 months. Approximately 20 percent reported a net decrease in L&D budgets.

Regarding headcount, 57 percent reported that their L&D headcount stayed the same; 10 percent reported a decline (compared to 32 percent in 2021), and 23 percent reported an increase in number of L&D staff (compared to 18 percent in 2021).

The top 5 most cited L&D priorities in 2023 were:

- Addressing skills gaps (29 percent)

- Linking L&D with organizational development (17 percent)

- Linking L&D with performance management (17 percent)

- Improving the induction/onboarding process (16 percent)

- Identifying changing skills requirements (15 percent)

Learning delivery in UK

According to CIPD’s Good Work Index 2024, perceptions of training and development opportunities are more positive, with over half of respondents feeling they receive the training and information needed to perform their job effectively and have opportunities to develop their skills. Similarly, a comparable proportion of managers agree they have the training and information to manage staff effectively.

The most common types included online learning (42 percent) and informal training, such as on-the-job learning (46 percent) and learning from peers (23 percent). Additionally, 10 percent said they attended external conferences, events, or workshops (see Figure 19).

More formal types of training were mentioned less frequently, such as blended learning, off-the-job training, in-house development, coaching, formal qualifications, and opportunities for secondment, job shadowing, or job rotation. Training specifically focused on emerging technologies, like AI or VR, was rarely mentioned, with only 2 percent referencing it, although it may occur within other forms of learning.

Other employee learning statistics

According to a 2023-2024 report by the Society for Human Resource Management (SHRM), training and development for people managers remain essential.

Enhancing people managers’ understanding of their roles and building their soft skills, such as empathy, are key initiatives for 2024, with 76 percent of HR professionals prioritizing these areas.

Upskilling or reskilling the existing workforce is a primary focus for 53 percent of organizations. This emphasis is critical for two main reasons:

- Employee upskilling and reskilling are among the least successful areas for many organizations. In 2023, only 21 percent of HR professionals reported their organizations were effective in this domain.

- The dual forces of Baby Boomer retirements and the rapid expansion of artificial intelligence capabilities are expected to heighten the need for workforce reskilling.

Tackling L&D challenges

In its 2024 L&D Impact Survey, Hemsley Fraser asked 766 L&D, HR, and talent professionals across the UK and North America from a wide range of sectors and organization sizes about the latest changes in the learning and development landscape.

Top cited key challenges for 2024 included

- Accessibility/technology

- Hybrid/remote working/learning

- Budgets/costs

- Workload

- Buy-in/resistance

- Capacity

- Time/resources

- Strategic alignment

- Engagement/attendance

- AI adoption

- Recruitment/onboarding/retention

- Content fatigue

- Conflicting business priorities

Cognota’s 2024 LearnOps Industry Report also found some similar trends including:

- Only 20 percent of L&D teams report being “strongly aligned” with business strategy.

- 69 percent of respondents prioritize improving productivity and performance as a key goal.

- 65 percent identify limited budgets as a primary challenge.

- 45 percent struggle with stakeholder engagement in the planning and executing L&D initiatives.

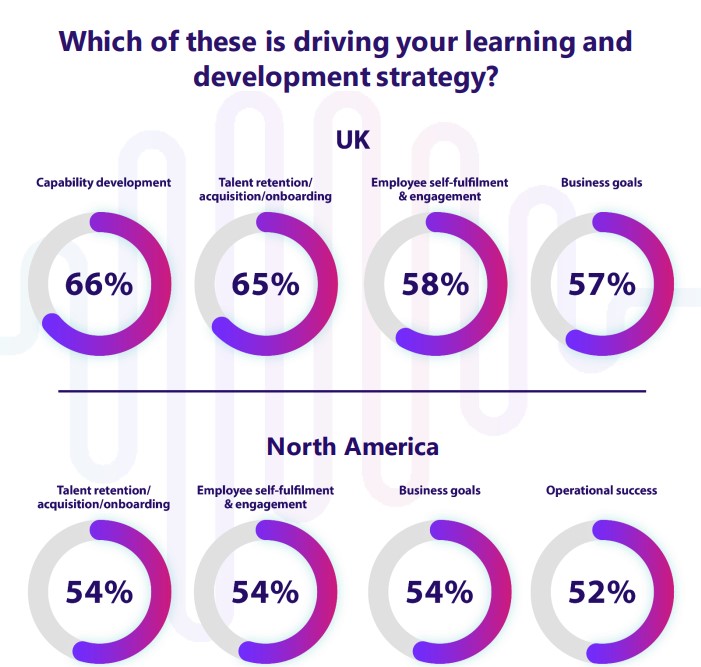

Most organizations aim to achieve greater alignment between L&D efforts and corporate objectives by 2025. The Hemsley Fraser report cited that in the United Kingdom:

- Capability development is the leading driver, with 66 percent of organizations identifying it as a key focus area. This reflects the growing need to equip employees with advanced skills and competencies to meet evolving business challenges.

- Talent retention, acquisition, and onboarding rank closely behind at 65 percent, emphasizing the importance of attracting and retaining skilled employees while ensuring a smooth integration into the workplace.

- Employee self-fulfillment and engagement are prioritized by 58 percent of organizations. This highlights the focus on creating a positive work culture that fosters personal growth and job satisfaction.

- Business goals also significantly guide 57 percent of organizations in aligning learning initiatives with overall strategic objectives.

In comparison, in North America:

- Talent retention, acquisition, and onboarding, employee self-fulfillment and engagement, and business goals are equally important, with 54 percent of organizations prioritizing each. This reflects a balanced approach to addressing workforce needs while ensuring alignment with corporate strategy.

- At 52 percent, operational success emerges as a distinct driver, underscoring the importance of learning initiatives that directly improve efficiency and performance.

Learning and development strategy drivers (2024). Source: hemsleyfraser.com

Tackling course creation challenges

Our experience at LearnExperts has been that slow course creation can be attributed to many reasons, but the number one reason is that the process today is still linear and traditional. People primarily interview subject matter experts (SMEs) and then translate their knowledge into course content using word processing tools (like Word or PowerPoint). This is a long and manual process that requires expertise.

Other reasons why course creation is slow include company and team size, the complexity of the course content, length of the course, schedules of SMEs, availability of reference materials and the adoption of technology for course creation.

Since the process of creating course content is still very traditional and manual, and we encounter it all the time in our client engagements, we decided to create LEAi, our digital course developer. This AI-enabled tool allows companies to use the material they already have to create well-structured knowledge-sharing and training programs.

With LEAi, you can now create instructor-led training, eLearning, knowledge base articles, virtual class content, presentations, webinars, videos and more in minutes rather than days, weeks or months.

If you are in the market for a course creation tool that will help to grow the number of hours of training per employee you provide while reducing training costs per employee or would like some advice on how to accelerate your L&D program, give us a call!